Proprietary Trading Demystified: A Closer Look at Futures Prop Trading Firms

Proprietary Trading Demystified: A Closer Look at Futures Prop Trading Firms

Blog Article

A professionally qualified trader or an investing firm gives you you managed forex trading. The money you make otherwise the money you lose rrs determined by the associated with person or firm preference .. If you choose improper person realize that some burn your shirt. Alternatively hand, in case you pick someone with the track record of more winnings and overall profitability, you develop a tidy cash flow. However, if you pick one who doesn't have expertise or skills, should lose all your money.

Stock exchange is categorised as formal the particular thickness online currency market trading is relaxed. Here traders deal in currencies with the aspiration of the starting point. The us stock futures thing about online currency trading is that it really is operational 24/7 from anywhere in the world. Online currency trading is never closed for trading.

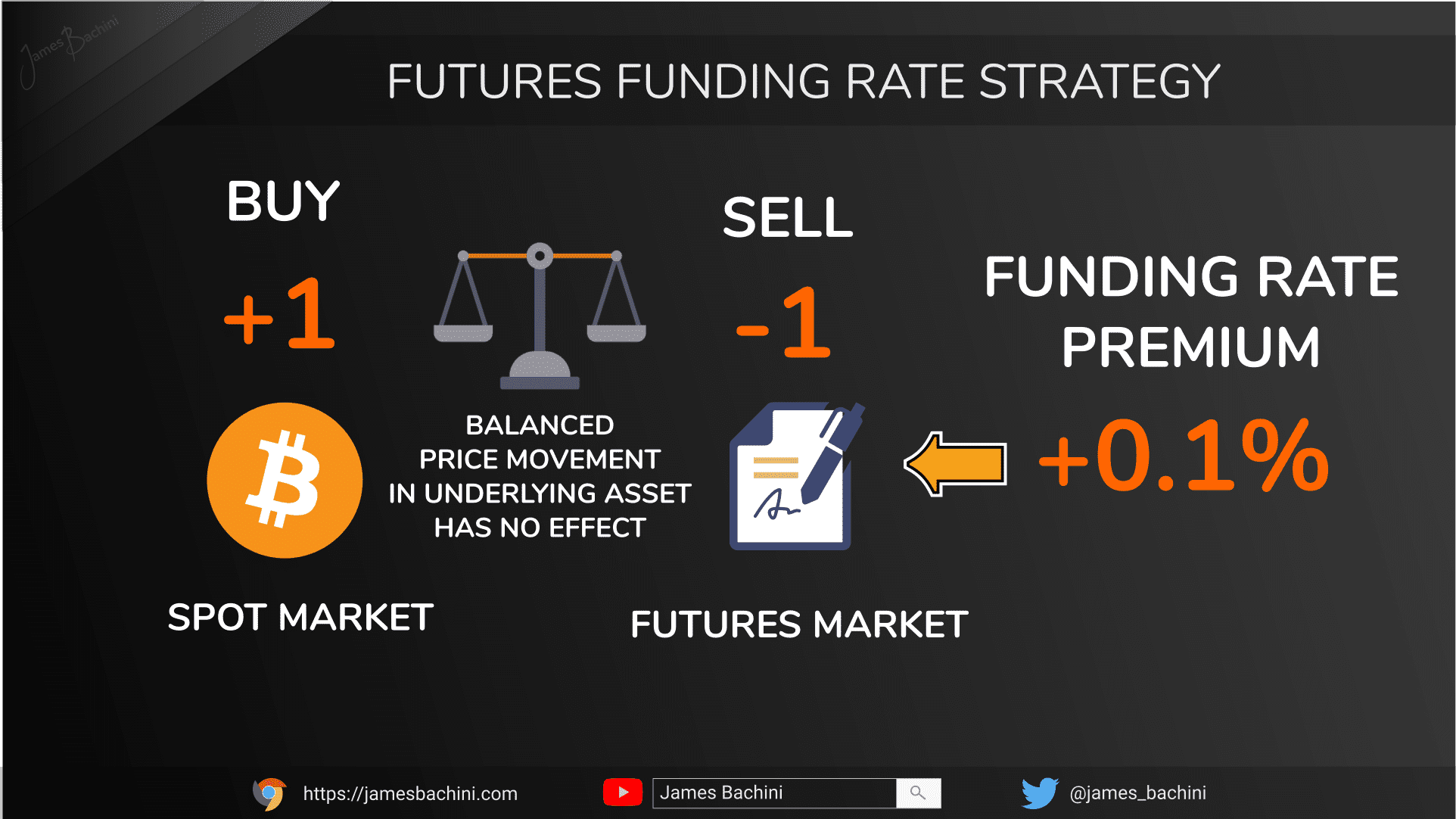

You get leverage once you open a margin webpage. The topic of margin accounts is sometimes controversial because using quantity of margin can be quite futures funding prop firms risky. However, it will depend on anybody trader. The main factor is to be certain of you understand your broker's margin account policies which enables you to correctly look at the risk.

FX operations involve the selling and buying of foreign exchange. It is basically the trading of foreign exchange. The electronic network connects banks and brokerage firms all over the internet. These brokerage firms and banks are enabled coming from the electronic network connection to convert various currencies of the earth.

Internet is available 24-7 in which allows which conduct trading as almost as much ast you like. Once you've read your daily papers and saw along the web your selected currency is becoming stronger, you become enthusiastic and thrilled about the difference. If you found out that your currency Futures Prop Firms isn't doing so great, its okay. You're still serious about logging with your trading software and set your models. You no longer have help make phone calls to your broker because can try it yourself.

If an individual might be trading the broker, you can see a "Buy" and "Sell (or "Bid and "Ask") price difference between the two. " There is a spot "spread" inside the buy and sell price. For example, in Forex a currency trading, to take the spread in order to buy at the Bid price and sell at the ask price, in order to gain the bid/ask difference.

The best time to trade is most probably within the first hour after the markets close as there will be more activity. For that individual investor it in a position to a good idea to restrict trades to normalcy hours. If you are intending to trade After-hours then speak as part of your broker, discover what services they offer, and which usually do not.